Credit and how to manage it is an important subject that is often neglected in high schools and even colleges, unless it’s a part of your degree field. However, it is something that everyone should at least have some knowledge about. Whether you are purchasing a car or renting/buying a house, your credit score is used for a long list of large purchases along with smaller, everyday items as well. We have put together a short list of things to keep in mind, along with tips, to make sure you understand the world of credit.

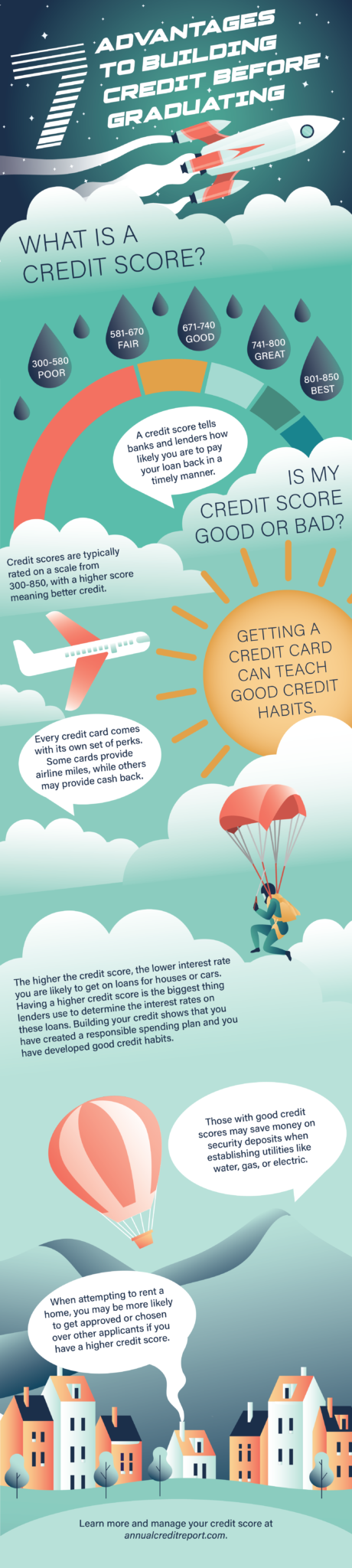

What is a Credit Score?

A credit score tells banks and lenders how likely you are to pay your loan back in a timely manner. It is based on your credit history which is a record of how much you have borrowed and paid back. Late payments decrease your score, while consistent, on-time payments will gradually increase your score.

What makes a Credit Score Good or Bad?

Credit scores are typically rated on a scale from 300-850, with a higher score meaning better credit. According to Experian, a credit reporting agency, 700 or above is considered good, while above 800 is excellent. The average credit scores fall in the 600-750 range. However, don’t be discouraged if your score is low, as there are many ways to raise it. These include making payments on time, cutting back on credit card spending, paying off debt, along with more ways that can be found with a quick internet search.

Keep these seven things in mind as you consider credit cards and building your credit:

1. Getting a credit card can teach good credit habits.

When getting a brand-new credit card, it can be tempting to spend money right away on non-essential items. Always set yourself a budget and never purchase anything that you couldn’t afford using your debit card. A good trick can be to put your groceries that you would normally buy on a debit card, on your credit card and pay it off immediately. This will slowly but surely begin to build your credit and help your credit score rise. Handled carefully, making smart choices, a credit card is an excellent way to build credit.

2. Cardholder perks

Every credit card comes with its own set of perks. Even cards from the same company have different rewards. Some cards provide airline miles, while others provide cash back. These are just two of the rewards credit cards can give you but there are a lot more out there. Student cards may come with a lower credit limit but can give the cardholder access to things like scholarships, 0% APR for the first year, and discounts on school supplies.

3. Receive lower rates on loans

Buying a car, a house, or any other large item is something that will more than likely require a loan from a bank. Many get the amount they apply for but the interest rates on these loans vary, and they can make a world of difference. Having a higher credit score is the biggest thing lenders use to determine the interest rates on these loans. Banks will see that you have a high score, meaning you are someone who doesn’t miss payments often and can be trusted to pay off the loan they are giving you. It can add up to a lot of saved money! Be careful, however, borrowing too much money or late payments will knock your credit score down.

4. Makes for a more appealing tenant

When attempting to rent a home, you will most likely have to submit your social security number so the landlord can see your credit score. You are much more likely to get approved or possibly chosen over other applicants if you have a higher credit score. This ties back to the loan section. The landlord will see that you have a high score and be more trusting of you to pay your rent on time and in full.

5. An increased credit limit on cards

The higher your credit score, the more willing a credit card company will be to give you a higher spending limit on your credit card. This can be nice for attempting to build your score higher or maybe covering you in an emergency situation you hadn’t saved up for. Maybe it’s an unforeseen health issue or car problems on a long road trip, a credit card can bring a sense of comfort knowing you have access to these funds in case a situation similar to these arises.

6. Save money on security deposits

Often, companies will charge a service fee when establishing utilities such as water, electric, or gas in your name for the first time or when moving to a new location. Having a good credit score can sometimes wipe these fees away completely!

7. Sense of achievement!

Having a good credit score is something to be proud of! Especially at a younger age. It is difficult to keep up on all of your payments, and adding another to the mix can be stressful and complicate things. If you are able to build your credit, that’s a big accomplishment. It shows that you have created a responsible spending plan and you have developed good credit habits. These are tools you will carry with you for life and will continue to be helpful as you progress into buying a home or whatever your next step may be.

Learn more and manage your credit score at AnnualCreditReport.com.