Think about a time when your house was filled with the sounds of stomping feet running through the hallway. Clothes splattered with food stains and dirt fill the hamper, waiting for their turn in the wash. A gallon of milk sits on the counter next to a half-eaten bowl of soggy cereal. The front door seems to open and close at a rapid pace, the slams echoing through the house. Toys are scattered across the floor — at night, you quietly pick them up, knowing very well they’ll be spewed across the floor again tomorrow.

Flash forward 10 or 15 years and these sights and sounds are nowhere to be found. The kids have grown up and are off to the next chapter in their lives: college. They’ve moved out. The quietness of the house is a welcome and strange feeling. You long for the sounds of pitter-pattering feet, the sights of jumping on beds, and the smells of family breakfast in the morning. You are now an empty nester, and it’s a bittersweet feeling… it is definitely a whole new world at home.

PsychCentral defines empty nest syndrome as, “the feelings of sadness, anxiety and loss of purpose that some parents and caregivers feel when their grown children move out of the family home.” These feelings could be confusing to some, as they could start off on a positive note (maybe you feel excited to finally have the house to yourself!), only to then take a turn in the other direction.

defines empty nest syndrome as, “the feelings of sadness, anxiety and loss of purpose that some parents and caregivers feel when their grown children move out of the family home.” These feelings could be confusing to some, as they could start off on a positive note (maybe you feel excited to finally have the house to yourself!), only to then take a turn in the other direction.

Empty nest syndrome can lead to mental health issues such as depression and anxiety or behaviors like financial risk-taking or substance misuse. It usually lasts about two months but could go on for longer, depending on other factors such as financial stress or health situations.

Self-Diagnosis Help

When your child leaves the house, you may feel mildly anxious or depressed. That is to be expected. If your sadness continues after a few weeks or if it starts affecting how you function on a daily basis, consider seeking mental health help. Empty nest syndrome tends to creep in unexpectedly.

How can you tell if you have empty nest syndrome? Here are symptoms PsychCentral says to look out for:

- Restlessness: You notice an inability to focus.

- Loneliness: You have an overwhelming sense of emptiness or feel unwanted and alone.

- Irritability: You snap over things that are not important, or you feel frustrated that you seemingly don’t have control of situations.

- Languishing: You have less energy and motivation for the things you used to do.

Most importantly, take note of your feelings and when they start. If you feel particularly down every day for at least two weeks, you’re likely experiencing depression.

There are other challenges that come with empty nest syndrome, most notably with your child and your partner. According to the Kentucky Counseling Center, these challenges include establishing and maintaining a new type of relationship with your adult child; learning how to be a couple again with your partner; figuring out how to fill your daily schedule now that there are fewer things to do; and possibly finding inconsideration and lack of sympathy from others because they don’t understand you.

The Kentucky Counseling Center also notes that full-time parents are most susceptible to empty nest syndrome. These reasons include experiencing a self-identity crisis due to the change in parenting roles, experiencing relationship struggles with their partner, or realizing that they are unable to live alone.

Coping Mechanisms

There are many ways to deal with empty nest syndrome. To start, PsychCentral shares these coping mechanisms.

There are many ways to deal with empty nest syndrome. To start, PsychCentral shares these coping mechanisms.

- Laugh More: Laughter really is the best medicine! It can lift your spirits and has many health benefits. Seek a smile — get together with friends and tell funny stories, or watch a comedy-filled movie.

- Discover Your Values: Speak your values aloud or write them down — it might help you re-examine what matters to you.

- Get to know your college student in a new way: You may think you know your adult child, but they are growing up and becoming a new person. Start communicating with them as an adult. Check in with them and ask how they’d like to catch up (a phone call, video, or over text).

- Exercise: From heart health to mental health, there are so many physical, mental and emotional health benefits to exercising regularly.

- Invest in yourself: Start a new hobby or go on that vacation that you’ve spoken about for years but never got around to planning.

- Practice self-care: Put yourself first. Eat well, treat yourself to a massage or take part in activities that interest you.

The Kentucky Counseling Center shares these additional tips:

- Acknowledge your grief: Allow yourself to feel sad and acknowledge your feelings. Talk about the sadness you’re experiencing with your partner or friends, and listen to their advice.

- Give yourself time: It always takes time to adjust to change — however big or small it is. Work on your own wellness during this time and establish goals that you’ve been looking to accomplish. If you’ve always wanted to get into yoga, now is the time to start! Meet new people by joining groups and taking up a new hobby. Keep your health in check too with a doctor’s appointment and checkups.

- Focus on the positive: Now that you have more time to yourself, this is a great opportunity to develop deeper relationships with friends, family and colleagues. And it’s likely that the relationship with your child who has flown the coop will only become stronger.

- Seek treatment: There is a line between empty nest syndrome and depression, so do not wait to get help from a mental health professional if this line is crossed.

Get Help 24/7

Help is always available. Call or text 988 – the national behavioral health crisis line – from anywhere in the U.S. to speak with a trained mental health provider via a secure online platform. They can help talk through issues such as depression, anxiety, eating disorders, self-harm, and suicide. The Crisis Text Line is open 24 hours a day, seven days a week.

First, check in without making it seem like you are interviewing them. Instead of asking what happened in their life today, ask how they are doing or how they are feeling. Give them your undivided attention. The most important thing to remember is that teens will come to you for your support when they need it.

First, check in without making it seem like you are interviewing them. Instead of asking what happened in their life today, ask how they are doing or how they are feeling. Give them your undivided attention. The most important thing to remember is that teens will come to you for your support when they need it.

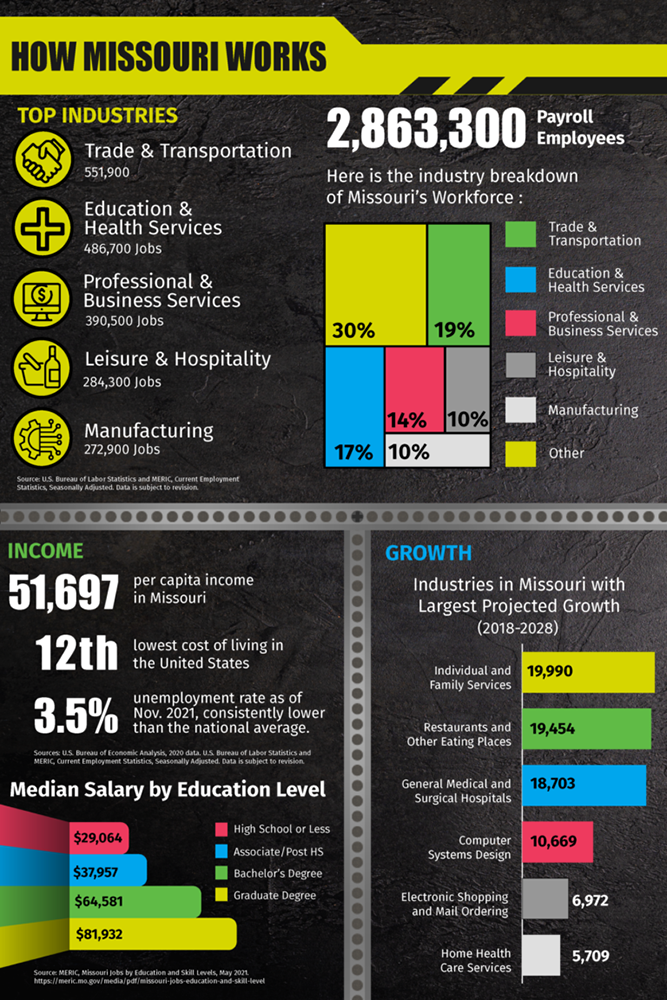

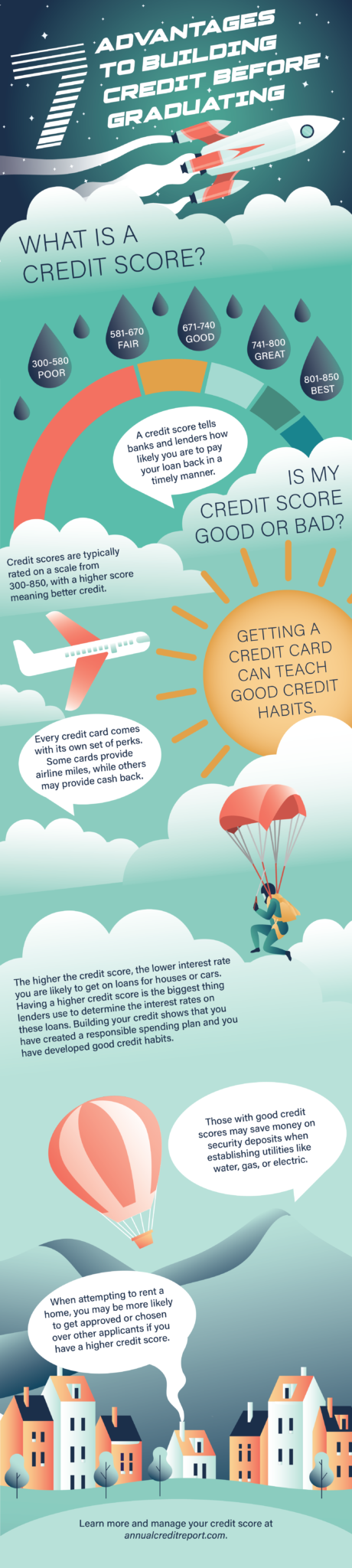

The best way your child can learn about financial responsibility is to create an open dialogue with them about money and remain transparent. According to a study from the

The best way your child can learn about financial responsibility is to create an open dialogue with them about money and remain transparent. According to a study from the  Financial stress around college can also impact mental health in negative ways, for a short period of time or more long-term.

Financial stress around college can also impact mental health in negative ways, for a short period of time or more long-term.  There are many benefits to advanced degrees. Increased earnings, switching careers, and even personal goals can be a part of the decision to pursue a master’s degree or higher. To truly make the smartest choice you should factor in everything that you can. The primary benefit of a graduate education is very specialized knowledge that can benefit you or your career path. This can be as simple as a school principal versus elementary teacher. It can also be very specific like choosing a course that uses a unique coding program for one sole purpose. Take inventory of what your goals and needs are, then look at what various schools can provide you. Course listings are provided that give a synopsis of each course offered.

There are many benefits to advanced degrees. Increased earnings, switching careers, and even personal goals can be a part of the decision to pursue a master’s degree or higher. To truly make the smartest choice you should factor in everything that you can. The primary benefit of a graduate education is very specialized knowledge that can benefit you or your career path. This can be as simple as a school principal versus elementary teacher. It can also be very specific like choosing a course that uses a unique coding program for one sole purpose. Take inventory of what your goals and needs are, then look at what various schools can provide you. Course listings are provided that give a synopsis of each course offered.

Additionally, while scholarships and grants for pursuing a graduate degree are available, there aren’t many of them, so financial decisions should be part of the process.

Additionally, while scholarships and grants for pursuing a graduate degree are available, there aren’t many of them, so financial decisions should be part of the process.

This scholarship is tailored to students in leadership roles on campus and is a renewable scholarship that can cover up to $5,000. It is available to current college sophomores, juniors, and seniors. Students with good academic standing and a 2.5 GPA or higher are eligible to apply. This scholarship requires three additional things; a list of activities and leadership positions (not from high school), a reference from a current advisor/professor, and a short answer on what being a leader means to you. By sending all of that information, as well as your EFC and school’s award letter, you are eligible to apply. This scholarship is open until May 31, 2022, and winners will be notified by June or July.

This scholarship is tailored to students in leadership roles on campus and is a renewable scholarship that can cover up to $5,000. It is available to current college sophomores, juniors, and seniors. Students with good academic standing and a 2.5 GPA or higher are eligible to apply. This scholarship requires three additional things; a list of activities and leadership positions (not from high school), a reference from a current advisor/professor, and a short answer on what being a leader means to you. By sending all of that information, as well as your EFC and school’s award letter, you are eligible to apply. This scholarship is open until May 31, 2022, and winners will be notified by June or July.

Colleges have budgets dedicated to promotion and advertising. Do not feel bashful in asking if they have anything to offer you on your visit. This could be a free shirt or pennant, a discount to the school store, free food in the dining hall, or waiving your application fee if you apply that day. They want you to enjoy your day just as much as you do, so don’t be afraid to see what they can offer.

Colleges have budgets dedicated to promotion and advertising. Do not feel bashful in asking if they have anything to offer you on your visit. This could be a free shirt or pennant, a discount to the school store, free food in the dining hall, or waiving your application fee if you apply that day. They want you to enjoy your day just as much as you do, so don’t be afraid to see what they can offer.