There are many paths to choose from after graduating college, including graduate school, entering the workforce, traveling, or serving your country in some capacity. Similar to high school, the more time you take to prepare for your future, the less difficult those decisions may be. Luckily, your college or university will have plenty of people and resources that can help you find your ideal path after graduation. Here are three major options to choose after college:

1. Continuing School: Keys for Graduate Education

Many professions, such as law or medicine, will require some graduate coursework before you can even apply for the job. If you chose one of those as your major, you probably already knew those requirements.

Many professions, such as law or medicine, will require some graduate coursework before you can even apply for the job. If you chose one of those as your major, you probably already knew those requirements.

The appeal of college as an undergraduate is as broad as possible. For graduate course work, it should be much more specific. When considering a graduate program or school there are plenty of different questions to ask. Does my current school have a the right program for my interests or do I need to attend a different school? Does my program have additional requirements (GRE, LSAT, etc.) that I must complete beforehand? How many students does my program accept? Is there any funding available for me? Do I have to attend classes in person or is there an online track? Addressing these before applying are fundamental to picking the right program. The sole purpose of these programs is to provide more professional experience that can help in your career and increase your earnings. Knowing what works best for you and what works best for your future is an important part of the decision making process.

2. Tools to Pick the Right Career

The two outcomes that colleges value the most are how many people graduate and how many of them are employed after graduation. They place an extremely high value on these and have many resources dedicated to helping students in their next phase of life. As a senior, you should know what’s at your disposal. Here are three resources to consider:

1. Opportunities for Your Major – Every college has a connection with their local area that includes partnerships and research opportunities. They often build good relationships in the community because those who partner with the campus can hire new talent from recent graduates. Therefore, many major programs will have information about offers exclusive to your academic discipline. Get in contact with your department head to see what opportunities they may have available to you.

1. Opportunities for Your Major – Every college has a connection with their local area that includes partnerships and research opportunities. They often build good relationships in the community because those who partner with the campus can hire new talent from recent graduates. Therefore, many major programs will have information about offers exclusive to your academic discipline. Get in contact with your department head to see what opportunities they may have available to you.

2. Your Career Center – Every university has a dedicated career center that’s sole purpose is preparing students for gaining employment. This can be limited to resume critiques or more involved like mock interviews and setting up networking opportunities. This is a valuable resource because they keep in contact with alumni who can give information about what it takes to make it into a career field. This helps the career center prepare students for a specific need such as working on a portfolio for an art school or mock interview questions from previous applicants. The more information you give them, the more they can assist you in finding and securing a job opportunity.

3. Attend a Career Fair – The career center will go above and beyond to help you prepare for what to do when you are applying for positions. They will also help with the hardest part, finding the companies that are hiring. Every year, companies will flock to college campuses in search of new talent to recruit either for internships or for job opportunities after graduation. Attending these is an essential step in preparing for the workforce after college. Many companies will stay and do first rounds of interviews based on the resumes that they receive. Keeping that in mind, you should check for a list of companies that were invited and prepare copies of your resume to hand out. Bigger universities will also have industry specific fairs or online job fairs, so check to see what your campus has to offer.

3. Attend a Career Fair – The career center will go above and beyond to help you prepare for what to do when you are applying for positions. They will also help with the hardest part, finding the companies that are hiring. Every year, companies will flock to college campuses in search of new talent to recruit either for internships or for job opportunities after graduation. Attending these is an essential step in preparing for the workforce after college. Many companies will stay and do first rounds of interviews based on the resumes that they receive. Keeping that in mind, you should check for a list of companies that were invited and prepare copies of your resume to hand out. Bigger universities will also have industry specific fairs or online job fairs, so check to see what your campus has to offer.

3. Alternative Forms of Employment: the Choice to Serve

If graduate school or the traditional workforce do not immediately jump out to you, perhaps you are interested in the chance to serve, either through religious organizations, non-profit sectors, or through the government. One of the best and most secure ways to travel internationally is through service like a mission trip or through the Peace Corps. Both require you to stay and serve a community for a period of time ranging from weeks to a few years with the Peace Corps. Either option can be extremely rewarding for those who choose these options.

If you are planning to stay in the U.S., there are similar ways to serve through AmeriCorps programs or through fellowships that target underserved communities.

If you are planning to stay in the U.S., there are similar ways to serve through AmeriCorps programs or through fellowships that target underserved communities.

Another admirable option is serving in the armed forces. The military is always looking for new recruits and those with a college education become instantly valuable, given chances to rise up in the ranks faster than those who immediately enlist out of school. Talk with a recruiter if this is something that interests you.

Change is inevitable when a student goes off to college. Students who have gone away have to adapt to a new place to live, new friends and teachers, new learning environments, and new challenges that come with this next phase in their lives. Parents have to adapt to new ways to give their support and be there for their student. One thing that remains the same, however, is the need for both sides to communicate how they are doing and feeling during these times.

Change is inevitable when a student goes off to college. Students who have gone away have to adapt to a new place to live, new friends and teachers, new learning environments, and new challenges that come with this next phase in their lives. Parents have to adapt to new ways to give their support and be there for their student. One thing that remains the same, however, is the need for both sides to communicate how they are doing and feeling during these times. If you believe a larger mental health issue is happening and that it is time to step in, first, determine the urgency of the situation. This will guide your approach to intervening. The University of Iowa shares this guidance about starting the conversation with students who are struggling with their mental health:

If you believe a larger mental health issue is happening and that it is time to step in, first, determine the urgency of the situation. This will guide your approach to intervening. The University of Iowa shares this guidance about starting the conversation with students who are struggling with their mental health:

This begs the question: What makes post secondary education an attractive option for some, but the complete opposite for others? The answer may be apathy.

This begs the question: What makes post secondary education an attractive option for some, but the complete opposite for others? The answer may be apathy. Within these conversations, College Parent Central wants you to encourage your child to explore their interests and find others who may share those interests. If they are having trouble making friends, share with them opportunities to volunteer, join a club, engage in activities on campus or find a part-time job they know they will enjoy. Remind them that there are many resources available at school, including health and counseling centers. Talk to them about self-care, whether that may be exercise, therapy or taking mental health days.

Within these conversations, College Parent Central wants you to encourage your child to explore their interests and find others who may share those interests. If they are having trouble making friends, share with them opportunities to volunteer, join a club, engage in activities on campus or find a part-time job they know they will enjoy. Remind them that there are many resources available at school, including health and counseling centers. Talk to them about self-care, whether that may be exercise, therapy or taking mental health days.

There are many ways to deal with empty nest syndrome. To start, PsychCentral shares these coping mechanisms.

There are many ways to deal with empty nest syndrome. To start, PsychCentral shares these coping mechanisms.

First, check in without making it seem like you are interviewing them. Instead of asking what happened in their life today, ask how they are doing or how they are feeling. Give them your undivided attention. The most important thing to remember is that teens will come to you for your support when they need it.

First, check in without making it seem like you are interviewing them. Instead of asking what happened in their life today, ask how they are doing or how they are feeling. Give them your undivided attention. The most important thing to remember is that teens will come to you for your support when they need it.

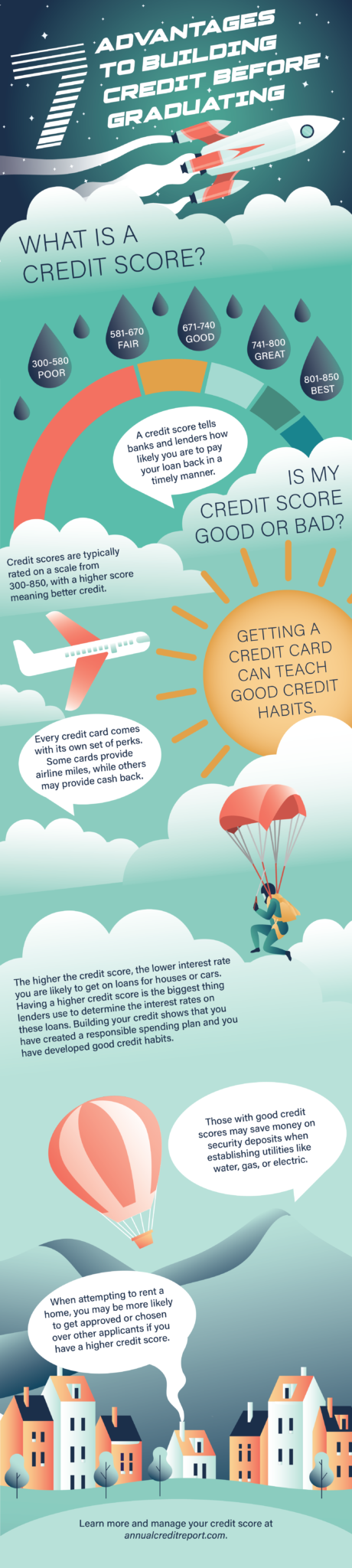

The best way your child can learn about financial responsibility is to create an open dialogue with them about money and remain transparent. According to a study from the

The best way your child can learn about financial responsibility is to create an open dialogue with them about money and remain transparent. According to a study from the  Financial stress around college can also impact mental health in negative ways, for a short period of time or more long-term.

Financial stress around college can also impact mental health in negative ways, for a short period of time or more long-term.  There are many benefits to advanced degrees. Increased earnings, switching careers, and even personal goals can be a part of the decision to pursue a master’s degree or higher. To truly make the smartest choice you should factor in everything that you can. The primary benefit of a graduate education is very specialized knowledge that can benefit you or your career path. This can be as simple as a school principal versus elementary teacher. It can also be very specific like choosing a course that uses a unique coding program for one sole purpose. Take inventory of what your goals and needs are, then look at what various schools can provide you. Course listings are provided that give a synopsis of each course offered.

There are many benefits to advanced degrees. Increased earnings, switching careers, and even personal goals can be a part of the decision to pursue a master’s degree or higher. To truly make the smartest choice you should factor in everything that you can. The primary benefit of a graduate education is very specialized knowledge that can benefit you or your career path. This can be as simple as a school principal versus elementary teacher. It can also be very specific like choosing a course that uses a unique coding program for one sole purpose. Take inventory of what your goals and needs are, then look at what various schools can provide you. Course listings are provided that give a synopsis of each course offered.

Additionally, while scholarships and grants for pursuing a graduate degree are available, there aren’t many of them, so financial decisions should be part of the process.

Additionally, while scholarships and grants for pursuing a graduate degree are available, there aren’t many of them, so financial decisions should be part of the process.

This scholarship is tailored to students in leadership roles on campus and is a renewable scholarship that can cover up to $5,000. It is available to current college sophomores, juniors, and seniors. Students with good academic standing and a 2.5 GPA or higher are eligible to apply. This scholarship requires three additional things; a list of activities and leadership positions (not from high school), a reference from a current advisor/professor, and a short answer on what being a leader means to you. By sending all of that information, as well as your EFC and school’s award letter, you are eligible to apply. This scholarship is open until May 31, 2022, and winners will be notified by June or July.

This scholarship is tailored to students in leadership roles on campus and is a renewable scholarship that can cover up to $5,000. It is available to current college sophomores, juniors, and seniors. Students with good academic standing and a 2.5 GPA or higher are eligible to apply. This scholarship requires three additional things; a list of activities and leadership positions (not from high school), a reference from a current advisor/professor, and a short answer on what being a leader means to you. By sending all of that information, as well as your EFC and school’s award letter, you are eligible to apply. This scholarship is open until May 31, 2022, and winners will be notified by June or July.